E-commerce trends in Ireland 2026 signal a transformative shift in how Irish businesses connect with customers online. Ireland’s digital commerce landscape is experiencing remarkable growth, with the market projected to reach USD 10.27 billion by 2030 according to Mordor Intelligence. This represents an impressive 8.71% compound annual growth rate from its 2025 valuation of USD 6.31 billion.

Irish businesses face both opportunity and pressure as consumer expectations evolve rapidly. The convergence of artificial intelligence, mobile technology, and regulatory frameworks is reshaping the competitive landscape. Whether you’re launching a new online store or optimizing an existing platform, understanding these emerging patterns will determine your success in Ireland’s digital marketplace.

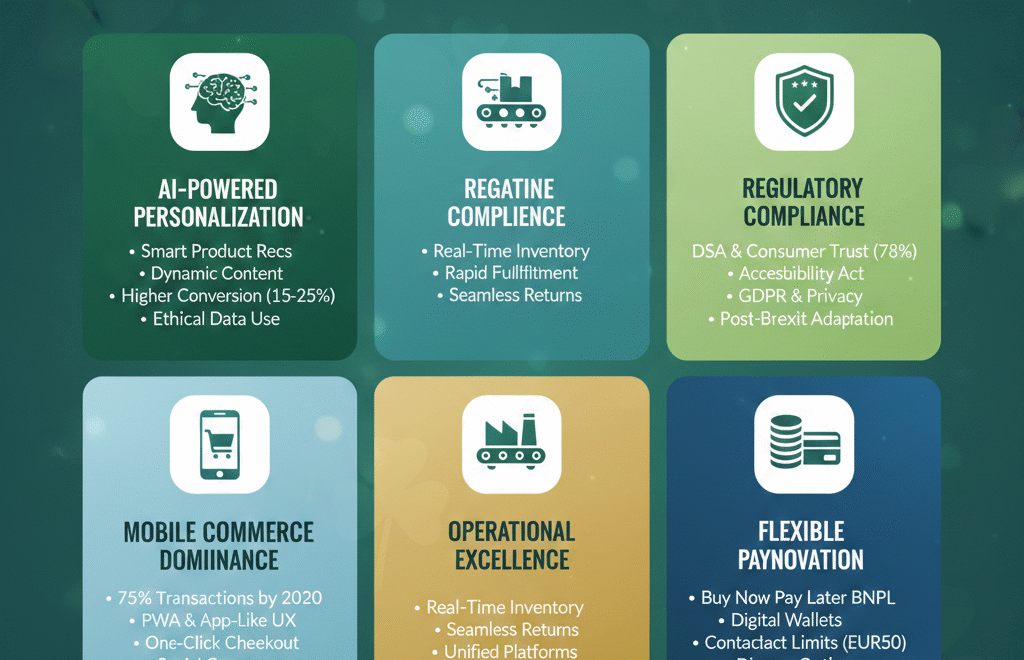

AI-Powered Personalization Transforming Customer Experiences

Artificial intelligence has moved beyond basic product recommendations to deliver hyper-personalized shopping journeys that adapt in real time. E-commerce trends in Ireland 2026 show that AI-driven personalization is no longer optional but essential for competitive advantage.

Irish consumers increasingly expect websites to recognize their preferences across every touchpoint. Research shows that 69% of consumers want a seamless experience across all channels, while organizations using AI-driven personalization report conversion rates 15-25% higher than those with generic approaches.

Machine learning systems now analyze browsing patterns, purchase history, and social media behavior to create targeted product recommendations. These systems process multiple data points simultaneously, including user interactions with specific pages, time spent on products, and comparison behaviors. When a customer checks a product page twice, compares prices, and saves items to a wishlist, AI models can predict an 80% purchase probability.

For Irish e-commerce businesses, this translates into several actionable opportunities. Dynamic product displays adapt based on individual user behavior rather than showing identical catalogs to every visitor. Personalized email campaigns with AI-written subject lines lift open rates by approximately 10%, while dynamic product blocks update in real time to reflect current inventory and pricing.

The financial impact is substantial. Companies using effective AI personalization generate 40% more revenue from personalization activities compared to slower-growing competitors. Additionally, 82% of businesses using AI to enhance customer experience see five to eight times the return on marketing spend.

However, Irish businesses must balance advanced personalization with strict GDPR compliance and evolving privacy expectations. Successful implementation requires transparent data usage explanations, meaningful consent choices, and personalization systems that respect anonymity where possible. Trust remains a core differentiator in the Irish market, making ethical personalization more valuable than aggressive data harvesting.

Implementing AI personalization doesn’t require massive budgets. Many modern platforms offer accessible AI tools for SMEs. The key is starting with high-impact areas like abandoned cart recovery, which typically recovers 3.33% of lost sales, and customer segmentation that clusters shoppers by intent, lifetime value, and discount sensitivity.

Mobile Commerce Dominance Reaching Critical Mass

Mobile commerce has evolved from a supplementary channel to the primary driver of online sales in Ireland. Smartphones and tablets now account for 68% of Irish e-commerce transactions, with projections suggesting this will rise to approximately 75% by 2030 as 5G coverage expands nationwide, according to market analysis.

The shift reflects fundamental changes in consumer behavior. Irish shoppers no longer plan dedicated shopping sessions at desktop computers. Instead, they browse products during breakfast, compare prices while commuting, and complete purchases during lunch breaks. This anywhere, anytime shopping mentality demands a mobile-first design rather thana desktop-first responsive adaptation.

Progressive web apps are becoming the standard for high-performing e-commerce sites in Ireland. PWAs deliver app-like experiences directly through browsers, combining speed, offline access, and push notifications without the friction of app store downloads. For Irish retailers, this offers faster load times on mobile networks, improved engagement and repeat visits, and reduced development costs compared to native apps.

The numbers validate this approach. By 2026, mobile commerce is expected to represent nearly 60% of total global e-commerce sales according to industry forecasts, with global mobile commerce revenue projected to exceed $2.5 trillion. Irish consumers participate actively in this trend, with smartphone usage at 90% and a strong willingness to make purchases via mobile devices.

Irish businesses must prioritize several mobile-specific optimizations. One-click checkout reduces friction that typically causes mobile cart abandonment. Digital wallet integration with Apple Pay, Google Pay, and local payment options streamlines transactions. Mobile-optimized product images and videos load quickly without sacrificing quality, while thumb-friendly navigation accommodates how people actually hold and use their phones.

Social commerce integration represents another critical mobile trend. Platforms like Instagram and TikTok now allow users to discover, review, and buy products without leaving the app. By 2026, social commerce is expected to account for over 20% of mobile commerce sales in several major markets. Irish businesses can capitalize on this by creating shoppable social content that converts browsers into buyers.

For businesses considering their digital marketing strategy, mobile optimization must be the foundation rather than an afterthought. The data clearly shows that Irish consumers have embraced mobile shopping, and businesses that fail to deliver exceptional mobile experiences will lose market share to more agile competitors.

Operational Excellence Becoming the New Competitive Edge

E-commerce trends in Ireland 2026 reveal a fundamental shift from marketing innovation to operational reliability. As online retail picks up both speed and scale, the ability to fulfill promises consistently separates market leaders from struggling competitors.

The battlefront has moved beyond customer acquisition to inventory accuracy, fulfillment speed, and data flow efficiency. Irish consumers now expect same-day delivery options, real-time stock visibility, and seamless returns processing. An Post and Amazon have reset expectations around delivery speed according to recent developments, pushing average order values higher and encouraging omnichannel investments by domestic retailers.

Inventory accuracy has evolved from a hygiene factor to a direct revenue lever. Inaccurate inventory data now carries immediate consequences through overselling, delayed shipments, and order cancellations that undermine customer trust and marketplace performance. Real-time inventory synchronization across sales channels prevents the frustration of discovering products are out of stock after completing checkout.

Returns management has become a strategic capability rather than an unavoidable cost. Smarter reverse logistics, faster restocking, and clearer visibility into returned inventory are essential for cost control and customer satisfaction in high-volume e-commerce environments. Irish businesses that streamline returns processing can turn potential negatives into competitive advantages.

Data velocity has replaced data volume as the critical metric. As e-commerce continues scaling, the challenge is no longer collecting more data but moving it faster. Timely, synchronized data across inventory planning, fulfillment networks, and cross-border logistics prevents friction at scale. Businesses entering 2026 are prioritizing system reliability, real-time data flow, and rapid adaptation when things break.

For Irish e-commerce operations, this means investing in unified platforms that coordinate orders, inventory, and fulfillment across multiple touchpoints. Selling across marketplaces, brand websites, and wholesale channels requires sophisticated order orchestration to prevent stockouts and fulfill orders from optimal locations.

Companies can leverage professional web development services to build the technical infrastructure supporting operational excellence. Strong backend systems enable the real-time data synchronization and automated workflows that customers now expect.

The message is clear: operational readiness determines growth ceiling. Businesses with scalable systems, reliable fulfillment, and responsive operations are positioned to grow. Those without operational readiness are increasingly limited by their own infrastructure limitations.

Regulatory Compliance Driving Consumer Trust

Ireland’s position as an English-speaking, euro-denominated gateway between the EU and UK creates unique regulatory dynamics that shape e-commerce success. The post-2024 rollout of the Digital Services Act increased Irish consumer trust in online shopping to 78%, up from 65% a year earlie,r according to European Commission data.

This trust dividend directly lowers customer acquisition costs for compliant businesses. Oversight split between media regulator Coimisiún na Meán and the Competition & Consumer Protection Commission provides dual-layer enforcement that international platforms now view as a competitive advantage rather than a compliance burden.

Several regulatory factors drive this trust ecosystem. Digital Services Act compliance reduces dispute-resolution times and chargebacks, which dropped 31% following DSA implementation. Tighter EU consumer rights rules have pushed trust indicators to historic highs, creating an environment where ethical businesses thrive while bad actors face consequences.

The upcoming European Accessibility Act makes accessibility compliance mandatory for Irish e-commerce sites. Beyond legal requirements, inclusive design improves usability for all users, not just those with disabilities. Clear navigation, readable typography, and accessible forms benefit every customer while also improving SEO and brand trust.

GDPR compliance remains non-negotiable for Irish e-commerce businesses. Successful companies implement privacy-by-design principles, transparent data policies, and clear customer communication. Irish consumers reward businesses that respect their privacy and provide genuine value in exchange for data sharing.

Brexit has complicated UK-to-EU e-commerce flows, with customs fees and longer transit times reducing UK-origin orders by 27%. This pushes Irish shoppers toward EU suppliers and domestic platforms, creating opportunities for Irish businesses to capture market share previously dominated by UK retailers.

For businesses seeking guidance on regulatory compliance, professional SEO services can help implement technical requirements like structured data and accessibility features that satisfy both search engines and regulatory frameworks.

The competitive advantage lies in viewing compliance not as a burden but as a trust-building opportunity. Irish businesses that exceed minimum requirements and communicate their ethical practices transparently will capture disproportionate market share as consumer scrutiny intensifies.

Buy Now Pay Later and Flexible Payment Innovation

Payment innovation is reshaping Irish e-commerce by reducing barriers to purchase and enabling larger basket sizes. The surge of Buy Now Pay Later (BNPL) options is translating into larger basket sizes and materially lower cart abandonment rates, according to market research.

BNPL partnerships with platforms like Klarna and Split Pay allow financially constrained consumers to shop online without immediate full payment. This flexibility particularly appeals to younger demographics who prefer spreading costs over time without traditional credit card interest charges. Irish retailers offering BNPL options report conversion rate improvements and higher average order values.

Raised contactless debit-card limits represent another significant payment evolution. Bank of Ireland data shows a 34% surge in contactless volumes after the limit moved to EUR 50 (USD 54) in 2025. Instant settlement rails championed by the Central Bank have removed payment friction points that historically deterred large online purchases.

Digital wallets already represent a growing share of Irish e-commerce transactions. The convenience of stored payment credentials, biometric authentication, and one-touch purchasing reduces checkout friction that typically causes cart abandonment. Irish businesses must integrate multiple digital wallet options to accommodate diverse consumer preferences.

Payment method diversity reflects changing consumer expectations. Credit and debit cards remain popular at 37% of Irish online payments, but e-wallets are strengthening their position at 24%. Traditional cash-on-delivery options are declining as consumers embrace digital payment security and convenience.

For Irish e-commerce businesses, a payment strategy requires balancing multiple priorities. Offering diverse payment options accommodates different customer preferences and financial situations. Ensuring secure payment processing builds trust and reduces fraud risk. Streamlining checkout reduces friction that causes abandonment.

Businesses can explore comprehensive e-commerce solutions that integrate multiple payment gateways, fraud detection, and compliance features. The technical infrastructure supporting flexible payment options directly impacts conversion rates and customer satisfaction.

The trend toward payment flexibility will intensify through 2026. Surcharging may shift from exception to expectation in industries where margins are tight and card costs are rising. Real-time reconciliation and compliance automation will become dominant forces in payment processing. Irish businesses that adapt quickly to these shifts will capture competitive advantages in the evolving digital marketplace.

Irish consumers have fully embraced the convenience of online shopping, driven by 24/7 access, time and effort savings, abundant choices, and easy price comparison. To remain competitive in this rapidly evolving landscape, businesses must align their value propositions with customer needs around intelligent technology, frictionless experiences, and responsible practices.

The e-commerce trends in Ireland 2026 point clearly toward a future where success depends less on chasing novelty and more on building resilient, responsive operations. Businesses that invest in AI personalization, mobile optimization, operational excellence, regulatory compliance, and payment flexibility are better positioned to absorb change, scale sustainably, and convert demand into durable growth.

Whether you’re launching a new online venture or optimizing an existing platform, partnering with experienced professionals can accelerate your success. Consider scheduling a free consultation to discuss how these trends apply to your specific business situation and develop a customized strategy for the Irish market.

The Irish e-commerce market presents extraordinary opportunities for businesses willing to adapt and invest strategically. By understanding and implementing these five critical trends, you position your business to thrive in Ireland’s dynamic digital commerce landscape throughout 2026 and beyond.